How to Set Yourself Up for Generational Wealth in Your 20s

Have you ever dreamt of living your ideal life? For many of us, it might be just a dream, but that dream can be a reality if you set goals and work hard. When you are in your 20s, you are in your pivotal time to set the foundation for your financial future. This period offers a unique opportunity to make smart decisions, establish healthy financial habits, and lay the groundwork for long-term prosperity. Building generational wealth is not easy because it takes years of hard work and discipline.

If you want to be like some of the Baby Boomers, who have a lot of assets and make up 21% of the country’s population, you need to start taking action today. No one is going to be responsible for your life except you. Will you make your dream a reality or will it be a dream forever?

Steps to Building Generational Wealth

1. Invest Early

Whether you have a low or high-income job, you must start investing early because time is your greatest asset. Compound interest is a powerful tool for building wealth. Over time, your money continues to grow. The earlier you learn to invest, the better your future will be. You can invest in many things, like stocks, ETFs, mutual funds, real estate, a business, a side hustle, or anything that sounds interesting to you.

Investing is a long-term game. You can’t get rich the next day. It has to be consistent.

2. Continue to Learn

The world is constantly changing, and there are always new things. You may think graduating college is the end of your education, but it’s not. If you want to be wealthy, you always need to learn and use that brain of yours. The mind is a powerful tool, so use it because no one can take that away from you. Continue to learn, thrive, and make money work for you, not the way around.

Why do you think people build their empires and expand them to become wealthier? They continue to learn, think, and implement strategies to make more money.

3. Reduce Debt

If you have debt, you must pay it off as soon as possible because debt will hinder your ability to build wealth. Focus on quickly paying your credit cards, student loans, and other debts. The quicker you pay them off, the more funds you can use for investment and savings. The more you hold on to your debt, the longer it will take you to pay it off. Use your money wisely so you can get back in the investing game.

4. Multiple Income Streams

Have you heard of inflation and how expensive life is? I think most of us have. If you don’t want to live paycheck to paycheck, you must diversify your income streams. People with generational wealth have one thing in common: multiple incomes. You can’t rely on one income source in this day and time.

People with generational wealth have money in real estate, stocks, businesses, and other investments. When they see an opportunity, they seize it. That is how their money continues to grow over time.

5. Networking

In a world with many people, you need to go out there and network because networking is a valuable asset in finance. You learn from other people. Build a relationship that will make your future brighter. You have mentors, financial advisors, and successful individuals who may be living your dream life. Go and build a relationship with them. Their insights might be something valuable to you.

6. Invest in Yourself

You didn’t have the option of being born into a wealthy family, but you can choose your future by investing in yourself. Things you see that help you grow as a person and make more money, you should invest it. Even if you didn’t expect it to go your way, you can always pivot because life is all about the journey, not the destination. Invest in continuous learning, skill development, and personal growth. Enhance your earning potential by acquiring new knowledge, certifications, and experiences that make you more valuable in the marketplace.

7. Protect Your Assets

As you slowly become wealthy, you need to protect it. People with generational wealth must purchase insurance policies like life insurance, disability insurance, and umbrella insurance to safeguard against unforeseen risks. In a world with greedy people, there will be those who want to sue and take your money.

8. Be Mindful of Spending

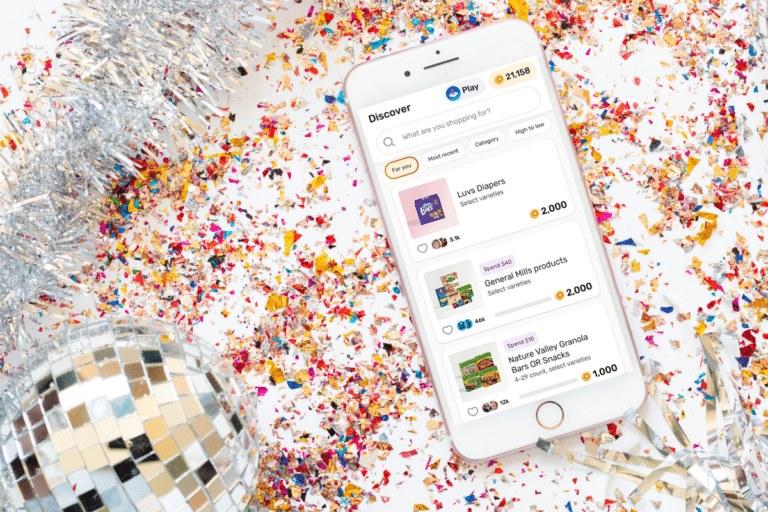

While you are on your journey to build generational wealth, you need to consider how you spend your money. Know the difference between your needs and wants because you won’t be tempted to pull out your credit card. Become an expert at shopping and saving. Avoid lifestyle inflation and unnecessary expenses that can drain your resources. Focus on investments that offer long-term value and contribute to your financial goals.

Wealth for the Win

By taking proactive steps in your 20s to build wealth, you can set yourself on a path toward financial independence and create a legacy of prosperity for future generations. Start today, stay disciplined, and envision the long-term impact of your actions on your financial well-being and that of your family.